Once you have found the perfect house, or received an offer on the home you are selling, one of the most important dates that gets added to your calendar is the Act of Sale. The Act of Sale is the actual closing, where all of the documents are signed, money is exchanged and the keys are handed over to the new owner. But when and where do you close?

When is the Act of Sale?

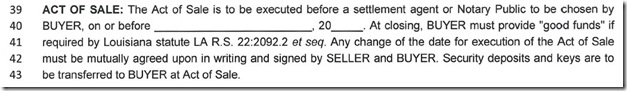

In Louisiana, the act of sale or closing date, like so many other things, is negotiated between the buyer and seller as part of the purchase agreement. Typically, buyers want to close as near to the end of the month as possible, because they will be pre-paying interest between the act of sale date and the end of the month. The closer to the end of the month, the less in pre-paid interest that they have to bring to the table.

An unfortunate reality today is that closing dates are changed more often than not. Delays in loan approvals and appraisals can push everything back, sometimes by a day or two, sometimes by weeks.

While the agents work hard to keep things on track, there are some things that are beyond our control (lenders and appraisers being a couple of them) and that may result in you being asked to sign an extension to the closing date. As noted in the purchase agreement, any changes to the date must be agreed to in writing by both the buyer and the seller.

Where is the Act of Sale?

The Louisiana purchase agreement requires that all real estate closings be held by either a settlement agent or a Notary Public. The settlement agent is usually a real estate attorney who works in conjunction with the title company. Occasionally, a title company may use a Notary instead of an attorney.

Typically, the closing takes place at the title company office, but there are title companies that will close off site if needed. I’ve been to closings that were held at real estate brokerage offices because that was more convenient for the buyer and seller.

The choice of title company is up to the buyer, because the bulk of the fees being charged by them are on the buyer’s side of the transaction. The exception to this rule is when the seller is a bank. Often, they have one title company that does all of their closings and they make it a condition of the sale that their closing company is used. When buying new construction, builders will sometimes offer a discount or help with closing costs in return for using their title company or attorney to perform the closing.