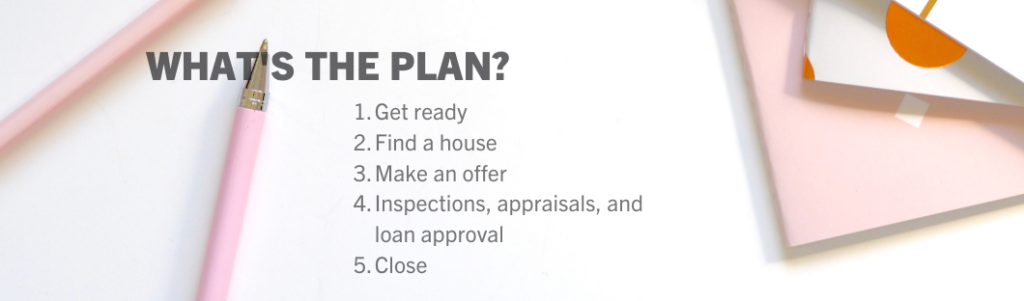

Every good New Orleans home buying guide starts with a plan

Buying a home is likely the largest single purchase you’ll ever make and Crescent City Living is here to prepare you for the process and help guide you through the sale.

We help you find the right place.

We’ll help you craft the right offer.

We help you decide when is the right time to stand firm or walk away.

We help you choose the right support team: inspectors, lenders, and title companies.

1. Get ready

MONEY, MONEY, MONEY

Will you be paying cash for your home or will you need to obtain a mortgage?

Unless you’re paying cash (real cash, not “I have some stock I could maybe sell” cash) you’ll need to connect with a reputable lender.

We strongly recommend a local lender who is familiar with Louisiana laws and customs. Ask for help if you don’t know anyone.

What will your lender need?

- 2 years of tax returns

- Most recent bank statements

- Most recent pay stubs

- Valid ID

- List of your current debts (credit cards, car notes, student loans, etc.)

The alphabet soup of mortgage loans

FHA – designed for eligible buyers who are unable to make large down payments.

FHA 203(k) – allows the buyer to borrow both purchase and repair/update funds.

VA – assists veterans or eligible family members to become homeowners with no money down.

RD – Rural development loans are 100% financing of homes in target areas. Income restrictions apply.

Conventional – any home loan not guaranteed or insured by the government

Tell us your dreams

Your dream home…

Consider your answers and share them with your REALTOR

Has _______________ bedrooms and _____________ bathrooms

Has a ____________________________ kitchen with ___________________________

The primary bedroom is __________________ and has ________________________

The yard is ________________________________________________________________

Has a big __________________________________________________________________

Has a small _______________________________________________________________

The neighborhood has ____________________________________________________

Choosing a New Orleans REALTOR

Of course, we’re a little biased and believe that the agents at Crescent City Living are the cream of the crop.

Before you choose a REALTOR to help with your home search, there are a couple of things to know.

We don’t practice dual agency

What does that mean? It means that we only represent YOU during your home purchase, not the seller. We won’t try to push you into our own listings and we pledge to put your interests before our own – always.

Related reading: Why we don’t practice dual agency

Buyer Brokerage Agreement

Effective 8/15/2024, all buyers must sign a buyer brokerage agreement before seeing any properties for sale. You can read more about these agreements HERE.

We’re a team

Part of putting your interests first is having an entire team to back up your selected agent. We don’t just have your back, we’ve got each other’s backs as well.

Your agent is on vacation? No problem.

Sick day? We’ve got it.

Questions about a particular listing? Just ask. A professional is available to help you.

2. FIND A HOUSE

The search

We are your ambassadors to the city and neighborhoods that you are considering for your home purchase.

Your Crescent City Living agent is able to provide you with up-to-date listings and can share their in-depth market knowledge to be sure you don’t ever overpay for a house.

START YOUR NEW ORLEANS HOME BUYING SEARCH HERE

What about For Sale by Owners?

If you see a house with a For Sale by Owner sign in the front yard, snap a pic or write down the details and send it to your agent. We’re experienced in negotiating with private sellers as well as with other agents.

A word about open houses

Open houses are so much fun! Wandering through, checking out all of the nooks and crannies. Right up until the listing agent starts trying to hard-sell you.

Grab a few of your agent’s business cards to keep with you. If you pop into an open house, just give a card to the listing agent or let them know you already have a signed buyer brokerage agreement with your agent.

3. Make an offer

Now that you’ve found the perfect place, it’s time to put pen to paper and write the offer.

The purchase agreement

The Louisiana purchase agreement is the contract for the purchase of a residential property. We’re well versed in the intricacies of writing contracts and how to protect your interest.

What we need to write your offer

- Price being offered

- Date of closing

- Type and terms of your mortgage loan (if applicable)

- Appraisal requirements (yes or no)

- Length of your inspection and due diligence period

- Amount of your deposit

ASK YOUR AGENT FOR A COPY OF THE CURRENT LOUISIANA PURCHASE AGREEMENT TO REVIEW BEFORE WRITING AN OFFER

4. Inspections, appraisal, and loan approval (oh my!)

CONTINGENCIES

What are contingencies? Contingencies are the list of things that must be completed before your contract becomes totally binding. Typical contingencies are inspections, due diligence research, loan approval, and appraisal.

Inspections and due diligence

As the buyer, you have the right to investigate the condition of the property, as well as confirming the zoning, square footage, flood zone, and other pertinent details about the house.

You are free to hire anyone you like, but we’re happy to help you find the right professionals to assist you.

Loan approval

Our team helps you stay on top of your loan approval so that there are no issues when it comes to closing on time.

Appraisal

The mortgage company requires an approved appraiser to inspect the property and determine the current value based on recent comparables sales in the area.

Also read: Home Buyers have a right to their appraisal

The cost of buying a New Orleans home isn’t limited to your down payment. There are additional expenses to be prepared for. Not all of these are applicable to every purchase, your agent will be your guide.

- Buyer agent commission – negotiable fee for your agent – most buyers ask the seller to pay the fee as part of the contract

- Deposit – minimum $500, maximum 1% of purchase price

- Title insurance – estimate 0.5 to 0.75% of purchase price

- Home inspection – $450 to $750

- Termite inspection – $95 to $150

- Plumbing video inspection – $250 to $350

- Elevation certificate – $200 to $400

- Structural engineer inspection – 4450 to $650

- Roofing inspection – $150 to $400

- Pool inspection – $250 to $400

THE DOS AND DON’TS OF NEW ORLEANS HOME BUYING

DO

- Get to know the neighborhoods – drive them during the day and the evening

- Tell your agent about any homes you want to view, even For Sale by Owners

- Get pre-approved for your mortgage

- Make a list of what is “must have” vs “nice to have” in your new home

DON’T

- Change jobs during the mortgage process

- Make any large purchases until after the closing

- Spend any of your down payment money

- Make unusual large deposits or withdrawals to your bank accounts

- Get married or divorced during the mortgage approval process

5. Close

WHAT TO EXPECT

The final walkthrough

Generally the day before or the day of your closing, the final walkthrough allows you one last look at the house before you sign all of the sale documents. This walkthrough is your chance to be sure that all negotiated repairs have been completed and that the house is in the same or better condition as when you made your offer.

WHAT TO BRING

There are just a couple of things you’ll need to bring with you to the closing:

- Valid driver’s license or state-issued ID

- If you aren’t wiring your closing funds, you’ll need a cashier’s check for any amount due at closing. The title company will advise you as to the balance needed on your closing day.

Need to sell a house first?

If you need to sell your current home before buying the next one, you should check out our New Orleans home selling guide.

Ready to get started on your New Orleans home buying journey?

Call us today at 504-327-5303